Innovation as a growth driver

Published on 02 10 2023Learnings from our Brand Growth Study Lisette Kruizinga – de Vries

This article discusses the findings from our Brand Growth study on the topic of Innovation. Since 2017, every year, we conduct our Brand Growth in which we dive into one specific ingredient for growth. Our key learning is that innovation is considered the most important ingredient for growth.

When marketers consider innovation as a growth driver, they frequently mention things related to technology and digital innovation, such as AI, automation, technology, VR, and AR. Further, winners (growing companies) also have more budget for innovation and test innovations more frequently before launching than losers. Pitfalls for innovation are discussed and concluded with implications for marketers.

introduction

Growth is a primary objective for many companies. All businesses as well as people would like to grow and therefore, growth and the how-to’s behind it are important and often discussed topics. The mission of DVJ is to help companies grow and realise their objectives. Our solutions are developed to support growth by making stronger brands, creating better advertising, innovating better, understanding shopper behaviour better, and optimising marketing spending. All are developed to support our client’s growth ambitions.

In 2016, DVJ founded the Brand Growth Platform, through which we wanted to bring learnings from different people with different perspectives from both science and practice together. The cooperation with academia consists of an academic board that we use for sparring and consultation, our PhD sponsorships to build extensive knowledge, and our cooperation with academic marketing researchers, professors and students. In addition to that, throughout each year, we conduct vision interviews with marketing leaders to better understand different ingredients for brand growth. Among the same target group, we also conducted a large-scale quant study, our Brand Growth Study, to be able to draw more general conclusions about brand growth.

BRAND GROWTH STUDY

Since 2017, we have conducted a yearly study amongst marketing professionals to validate our ideas, zoom in on a specific topic and come up with recommendations to use in marketing and marketing research. In the early years of the study, the focus was on our core countries – the Netherlands, the UK, and Germany. Since 2021, we expanded the scope and broadened to Europe, spanning more than 10 countries, including also the Nordics, Southern, and Central Europe. By now, we have data for our yearly large-scale quantitative Brand Growth study spanning 7 years of research among thousands of marketers and insight managers across Europe. In the last study, we interviewed over 2.000 marketing professionals.

different ingredients for growth

Each year, we focus on a different ingredient for growth, follow closely the developments in the academic world and zoom in on this topic in our vision interviews. Throughout the years, we have touched upon a lot of different ingredients, among which are media, creative development, data-driven decision-making, CSR, and innovation on which we mainly focused in 2019. Several interviews were conducted on this subject, with a summary available on our website. The brand growth study, focused on innovation, aimed to find answers to: Which companies are perceived as innovative? What are sources of innovation and who is responsible? Is research involved in the innovation process? What are the pitfalls of innovation?

In 2022, we wanted to know whether the results have changed and hence the questions about innovation were asked again which enabled us to make comparisons over the years and see how the behaviours and perceptions might have changed. Worth mentioning is that in 2019, the study was conducted in the Netherlands and the UK, and in 2022 different countries across Europe were covered. Considering the sample size and diversity we observed only ample differences in findings.

Additionally, the study measures the success of each company which enables us to see what separates the well-performing companies from the rest and helps clients to develop winning strategies. The results of the study are for that reason always a guideline for how to integrate this ingredient in the best possible way in the growth strategy. Study results from the past years confirmed all the researched brand growth ingredients to be differentiators between ‘winners’ (firms with increasing revenues) and ‘losers’ (firms that have stable or decreasing revenue). By analysing the data, we learn what ‘winners’ do differently than ‘losers’.

innovation is the most important ingredient for growth

In an open question, we have asked marketers what they believe is the most important driver of growth. Innovation stands out, closely followed by awareness, relevance, and reputation. Other important elements considered are penetration, salience, purpose and consistency (see Figure 1).

Figure 1: Key drivers of growth

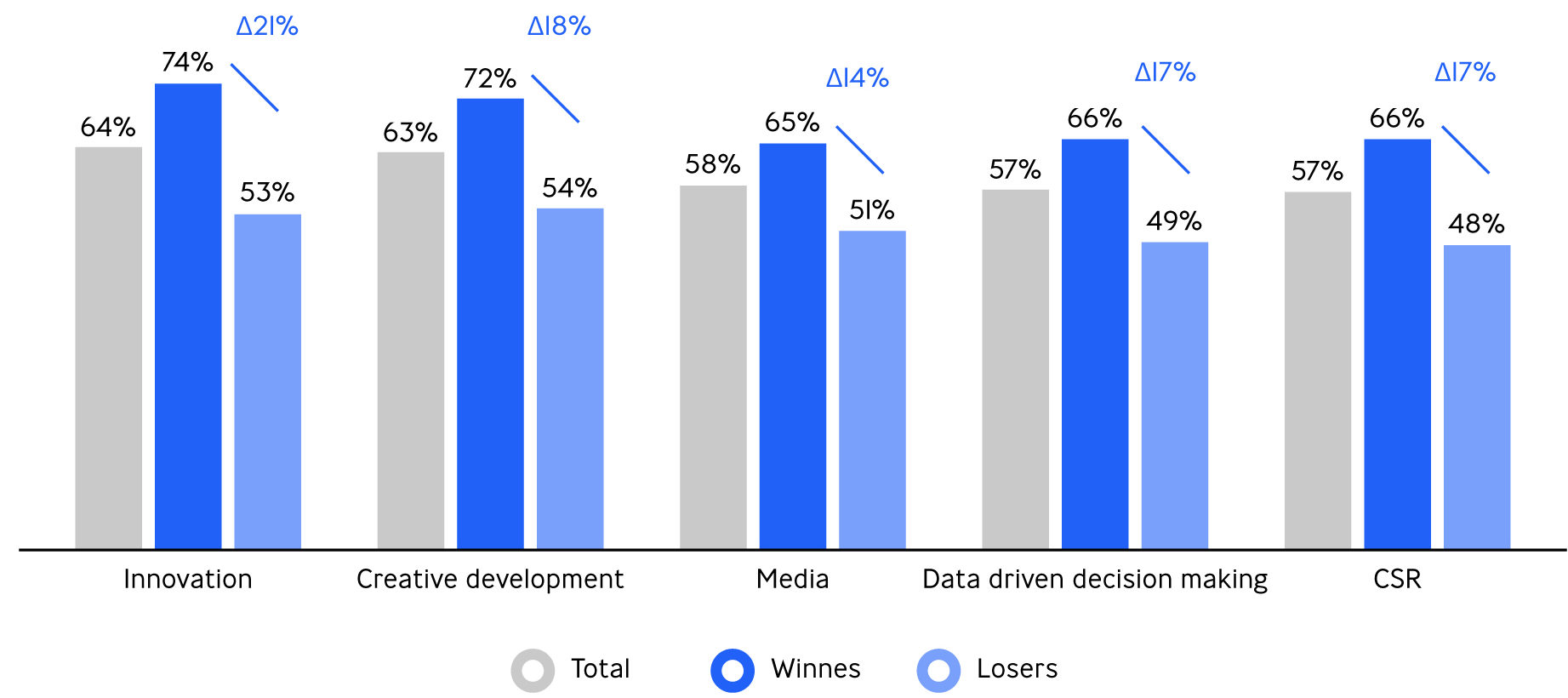

And it was also quantitatively confirmed that innovation is the most important driver of growth (see Figure 2). Further, creative development closely follows the top rankings of the important growth driver. Interestingly, winners believe in these factors more than losers, with the largest difference between winners and losers especially in innovation. Academic studies have also found that innovation and new product introductions have positive effects on firm value (Sorescu & Spanjol, 2008; Sood & Tellis, 2009) and are a major driver of economic growth (e.g., OECD, 2015).

And it was also quantitatively confirmed that innovation is the most important driver of growth (see Figure 2). Further, creative development closely follows the top rankings of the important growth driver. Interestingly, winners believe in these factors more than losers, with the largest difference between winners and losers especially in innovation. Academic studies have also found that innovation and new product introductions have positive effects on firm value (Sorescu & Spanjol, 2008; Sood & Tellis, 2009) and are a major driver of economic growth (e.g., OECD, 2015).

Figure 2: Key drivers for growth within the organisation

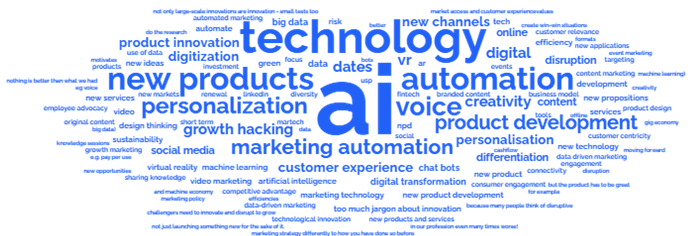

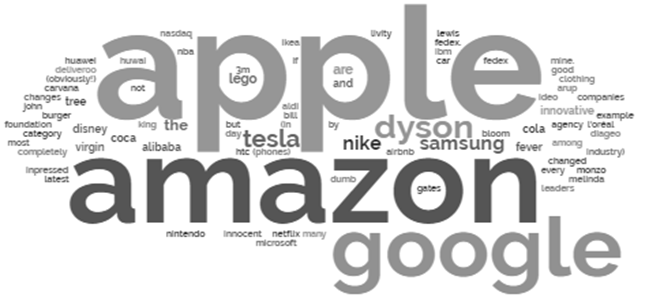

We have also investigated what comes to marketers´ minds when they think about innovation specifically as a driver for growth (see Figure 3). Surprisingly, already in 2019, AI popped up as the most often mentioned word.

Figure 3: What comes to your mind when you think of innovation as a growth driver?

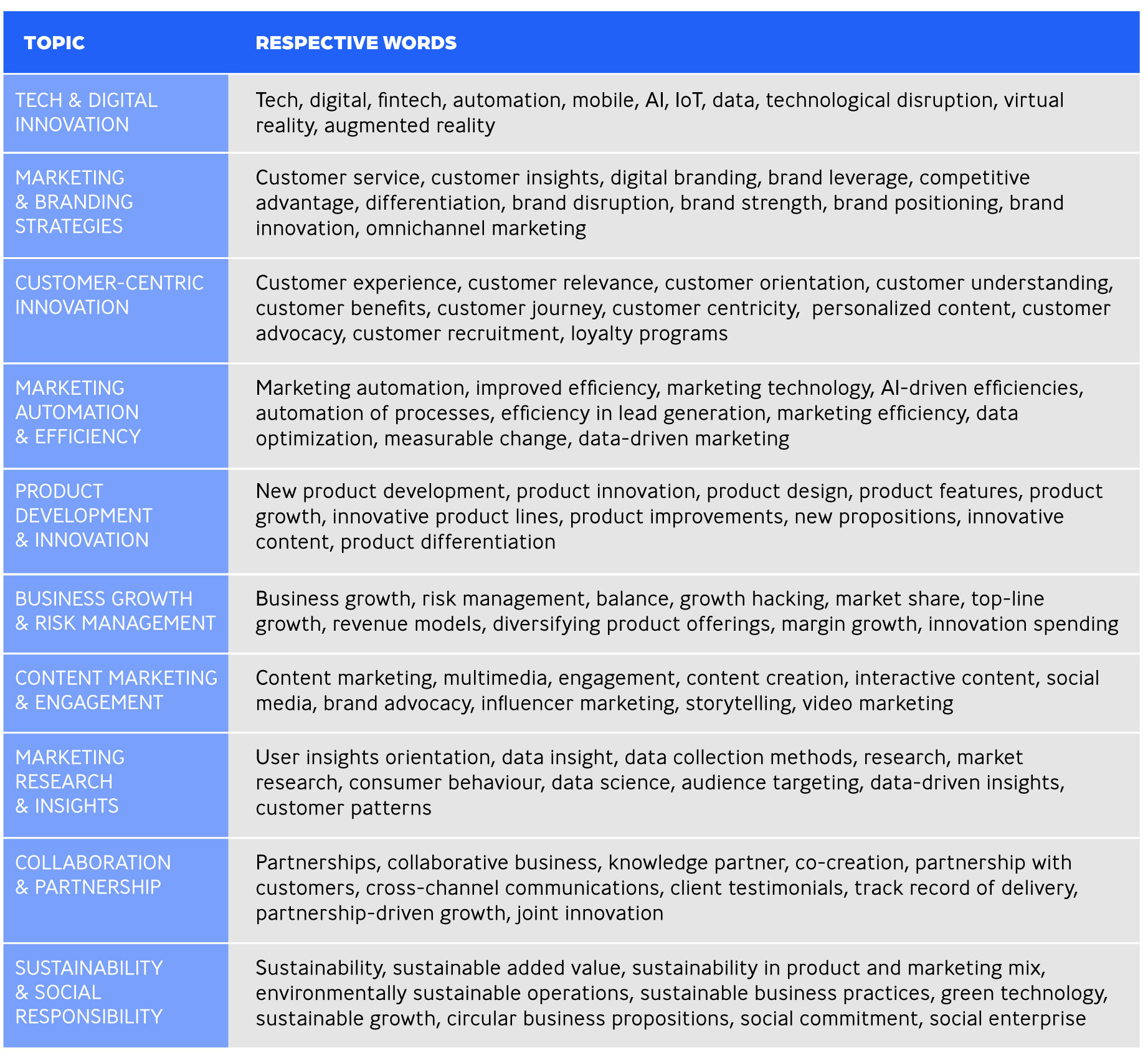

To make use of a very popular AI tool, we were interested in how ChatGPT would process these collected associations and categorise all of the words. We simply enter all the words mentioned by marketers and ask ChatGPT to categorise them into a maximum of ten topics. Within one minute it comes back with a clear classification, which would take a researcher at least a few hours. This is a good example of how we, at DVJ, implement AI into our tasks that are extremely time-consuming when done manually and use AI to help save time to add more value.

Table 1 presents the topics that ChatGPT finds in the provided input. A shortcoming of ChatGPT is that it is unable to count the words and calculate the relative importance of each topic as it is not trained in that. It can only identify patterns and information based on the text data it was trained for.

Table 1: ChatGPT’s classification of all mentioned words for innovation as a growth driver

Most & least innovative companies

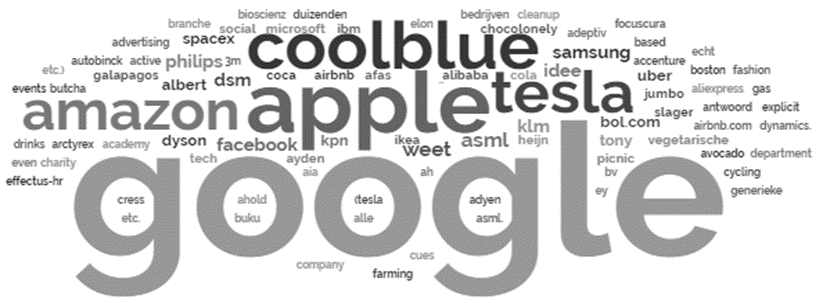

Which companies are considered as most innovative? Since we see some differences among countries, we separated the answers for the Netherlands and the UK even though large global players are mentioned by both countries.

In the Netherlands, Google is considered the most innovative company, followed by Apple, Coolblue, Amazon and Tesla. Whereas these are all global players which are also mentioned by UK respondents, we also see some typical Dutch companies such as Philips, Albert Heijn, ASML, bol.com, de Vegetarische Slager, KLM, and Tony Chocolonely (see Figure 4a). In the UK, Apple and Amazon are most often mentioned, closely followed by Google. The local heroes are Dyson, John Lewis, 3M, and Virgin (see Figure 4b).

Figure 4a: Most innovative company NL

Figure 4b: Most innovative company UK

Figure 4b: Most innovative company UK

winners have more Budget for innovation

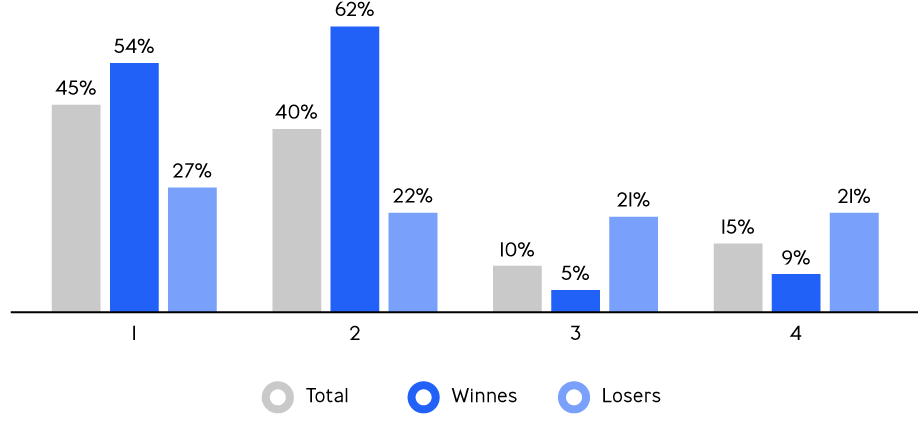

The largest differentiation between winners and losers was in budget allocation for innovation – whether it has increased, remained the same or decreased in the past year. In 2019, 45% of respondents indicated their innovation budget has increased, versus 40% in 2022. Of course, the year 2022 is already post-pandemic but other challenges appeared such as price inflation, war, and shortage on the job market.

Interestingly, growing companies (winners) indicate that their budget has increased much more frequently (54% in 2019: 62% in 2022), compared to losers (27% in 2019: 22% in 2022). Furthermore, losers see their budgets decrease more frequently (21% for both years), whereas winners see their budgets decrease only occasionally (5% in 2019: 9% in 2022). Of course, having a larger budget allows you to focus more on innovation.

Approximately 35% of the respondents believe that the innovation responsibility lies with the Chief Marketing Officer (CMO). However, some respondents also attribute this responsibility to the CEO, while others point to multiple individuals or teams. These teams could include the entire management team or even everyone within the organization, emphasizing the inclusive nature of innovation where contributions and fresh ideas can come from anyone.

Figure 5: Innovation budget increase or decrease – winners vs. losers in the past 4 years (2019-2022)

where does the inspiration for innovation come from?

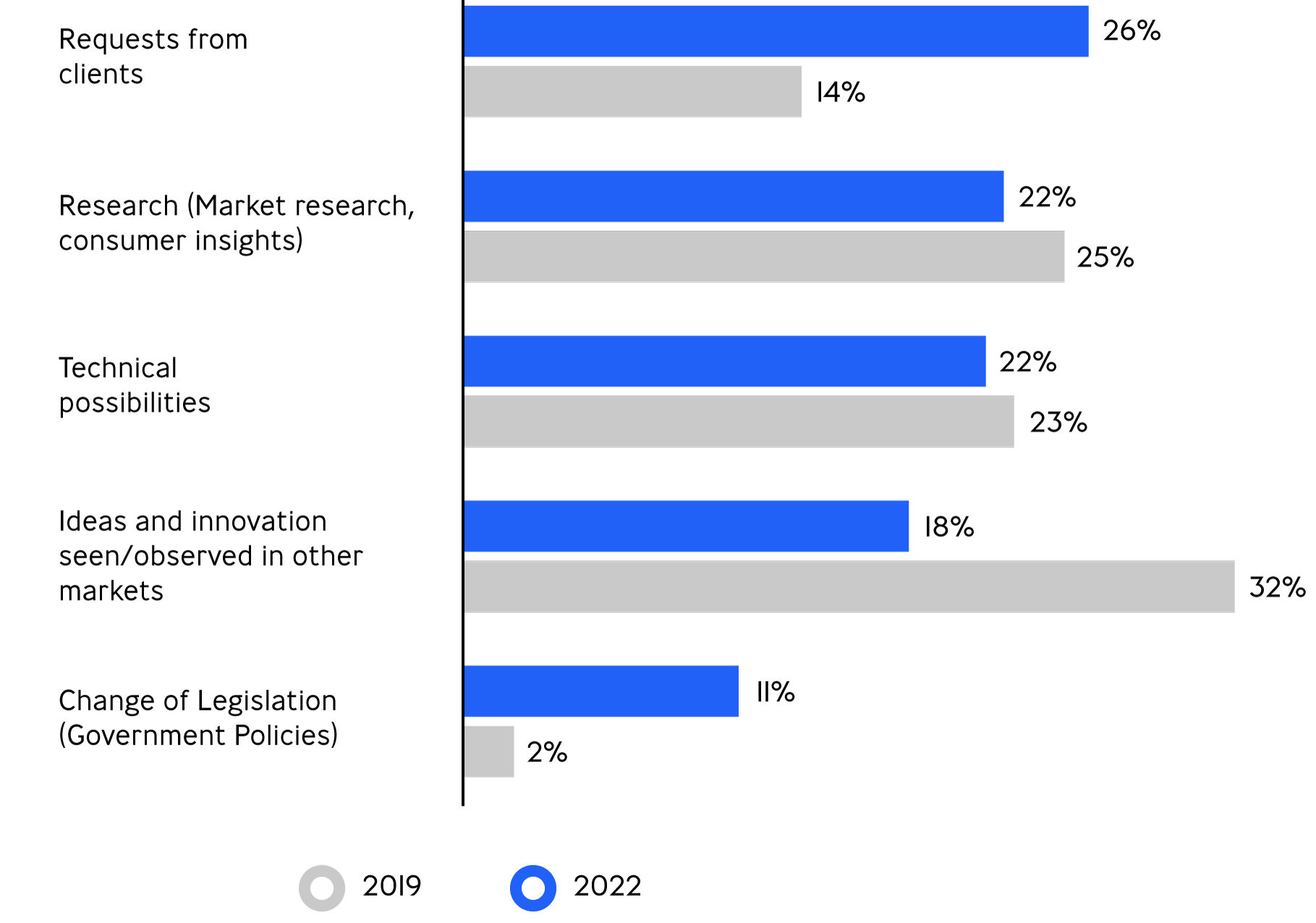

Let´s have a look at what are the sources of inspiration for innovation. Interestingly, the most common sources are requests from clients, research, technical possibilities, and ideas & innovations seen in other markets (see Figure 6). Interestingly, the latter dropped from 2019 to 2022, which could possibly be a consequence of the COVID pandemic as people were less able to travel and get inspired. Requests from clients became more important as an innovation source, which is a positive development. We do observe a few minor differences in inspiration sources of innovation between winners and losers. Losers use less often research and technical possibilities as sources than winners.

Figure 6: Inspiration sources for innovation – year-to-year comparisons

which innovation to go for?

It is important to test the innovation before launching it. In this case, we again see that the bigger group that does not conduct research for innovation at all are losers (12%) rather than winners (6%). Still, this means that about 90% of respondents are using research for innovation.

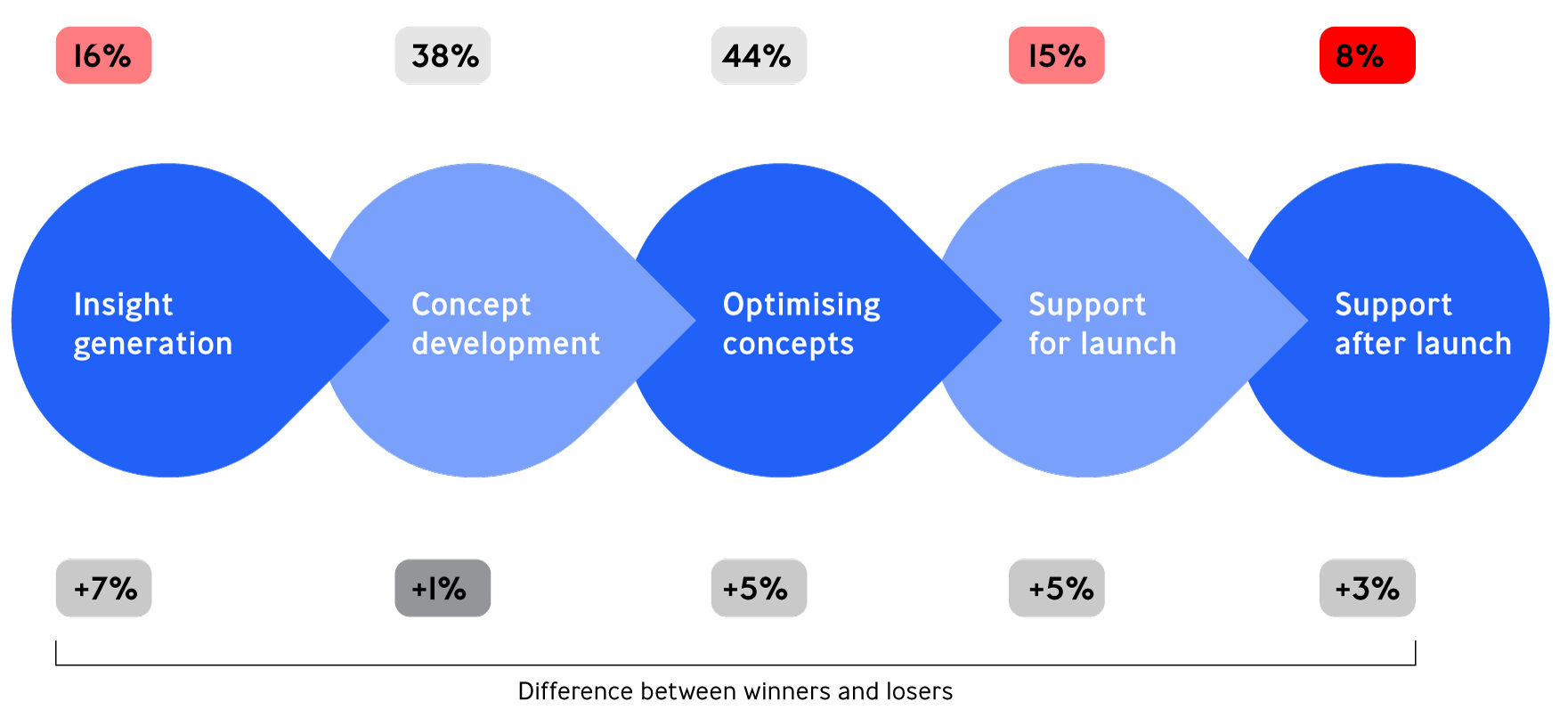

But at which phase of the innovation process is research being used? The most common ones are concept development (38%) and optimisation (44%). Significantly less research is used for insight generation (16%), support before (15%) and after launch (8%). Winners also test more often than losers. Especially in the insight generation (+7%), optimising the concept (+5%) and support for launch phases (+5%). We analysed data throughout the years and as we observed the same patterns, the presented results above are used from the most recent data collection, the year 2022.

Figure 7: Conducting research in different phases of the innovation process

ready, SET, launch?

Following testing, potential modifications to the concept are made. Does this imply that it is ready to be launched and that innovation will be successful? Well, there is more to it and we have examined what are the most common pitfalls in innovation. Of course, we know that a lot of innovations fail and next to the most common failures described in this article, there are several other pitfalls.

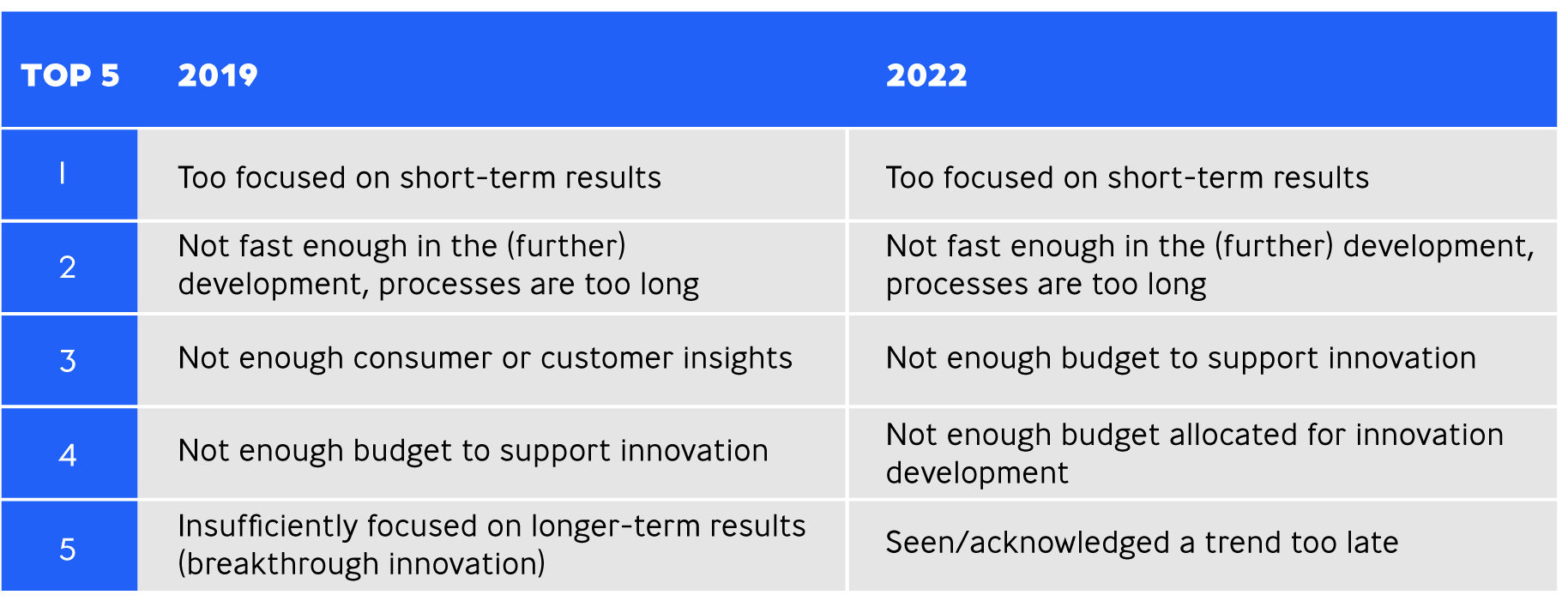

In both 2019 and 2022, the number 1 pitfall of innovation was to be too focused on short-term results, and the second best not fast enough in the development, processes are too long. Other important pitfalls are that there is not enough budget either for innovation support or development, not enough consumer or customer insights (something that is again related to lack of market research) or that a trend has been recognized too late. These pitfalls provide important implications for marketing or innovation managers.

Table 2: Top 5 pitfalls

Recap & implications

- To summarize, innovation is one of the most important drivers of growth which was confirmed both qualitatively as well as quantitatively.

- When exploring topics using innovation as a growth driver, AI instantly comes into the spotlight. We can categorize it under the more overarching theme of “Technology and Digital Innovation”.

- Winners have a larger budget for innovation and use market research more frequently in various stages of the innovation process.

- Testing is essential because it reveals potential flaws in the concept, which can be improved before launching.

If you want to grow as a firm, investing in innovation is crucial. Multiple sources confirm that innovation is a big driver of growth. Hence, make sure to devote the budget to innovation. In addition to that, conducting research on innovation in the different phases of the innovation process increases the chances that the innovation will be successful. Then, it is also important that the organisation processes are in place to ensure timely introductions of innovation. So, if possible, enable short internal processes and organise the organisation around innovation. Finally, make sure that the innovation is not only focused on short-term results, such as quick sales but also make sure it is an innovation that will yield more long-term results and is there to stay.

Our innovation concept testing

Are you about to launch a new product? Are you curious about the market potential of your concept? Does your new product meet the expectations of the consumer? Visit our product page offering solutions that will help you with your concept and/or current product performance.

References

OECD (2015). The impact of R&D investment on economic performance: A review of the econometric evidence. Accessed via: https://one.oecd.org/document/DSTI/EAS/STP/NESTI(2015)8/en/pdf

Sorescu, A.B. & Spanjol, J. (2008). Innovation’s effect on firm value and risk: Insights from consumer packaged goods. Journal of Marketing, 72(March), 114-132.

Sood, A. & Tellis, G.J. (2009). Do innovations really pay off? Total stock market returns to innovation, Marketing Science, 28(3), 442-456.