British consumers are getting anxious: Budget cuts in all categories

Published on 11 11 2022It is no secret that the cost of living has increased tremendously in recent months. Due to the war in Ukraine and rising rates of fossil fuels and raw materials, general inflation in Europe will remain high for longer. A price study in June uncovered the emotional impact and changing consumer behaviour due to price inflation. To better understand the impact of the current situation a follow-up study is conducted among 3,337 people in six European countries: The UK, Germany, The Netherlands, Sweden, Norway, and Denmark. Brits are feeling like victims of the crisis. They are now not only worried, but also getting anxious, angry, and frustrated. Next to its impact on their daily lives and financial situation, Brits also feel effects on their mental health and relationships.

Brits feel emotional despair and anxiety

The German, British and Dutch consumers are much more emotionally overwhelmed by the current price inflation compared to their state of mind four months ago. Based on our research, Brits claim to be worried, scared, and anxious due to the current economic situation, and 18% feel like victims of the crisis. This is in line with the inflation figures: Price inflation is the highest in the Netherlands at 14,3%, followed by Sweden (10,8%), Germany (10,4%), the UK (10,1%), and Denmark (10%). Norway shows the lowest actual price inflation (6,9%). Source: Trading Economics.

We even noticed a serious socially strained effect among people in the UK, Germany, the Netherlands, and Sweden who have reported that price inflation has a significant impact on close relationships with their partners, family, and friends. The number of socially strained Brits has risen by 10% in the past four months, up to 21%.

Major impact on daily lives and financial situation

More than half of British consumers (53%) feel that price inflation affects their financial situation, of which 17% face serious financial problems. However, British consumers now have a better understanding of how to save money. Significant changes in their behaviour have been observed in recent months. Savings decisions on media streaming and sports have become less important in comparison to June, while budget cuts in the leisure activities segment have increased.

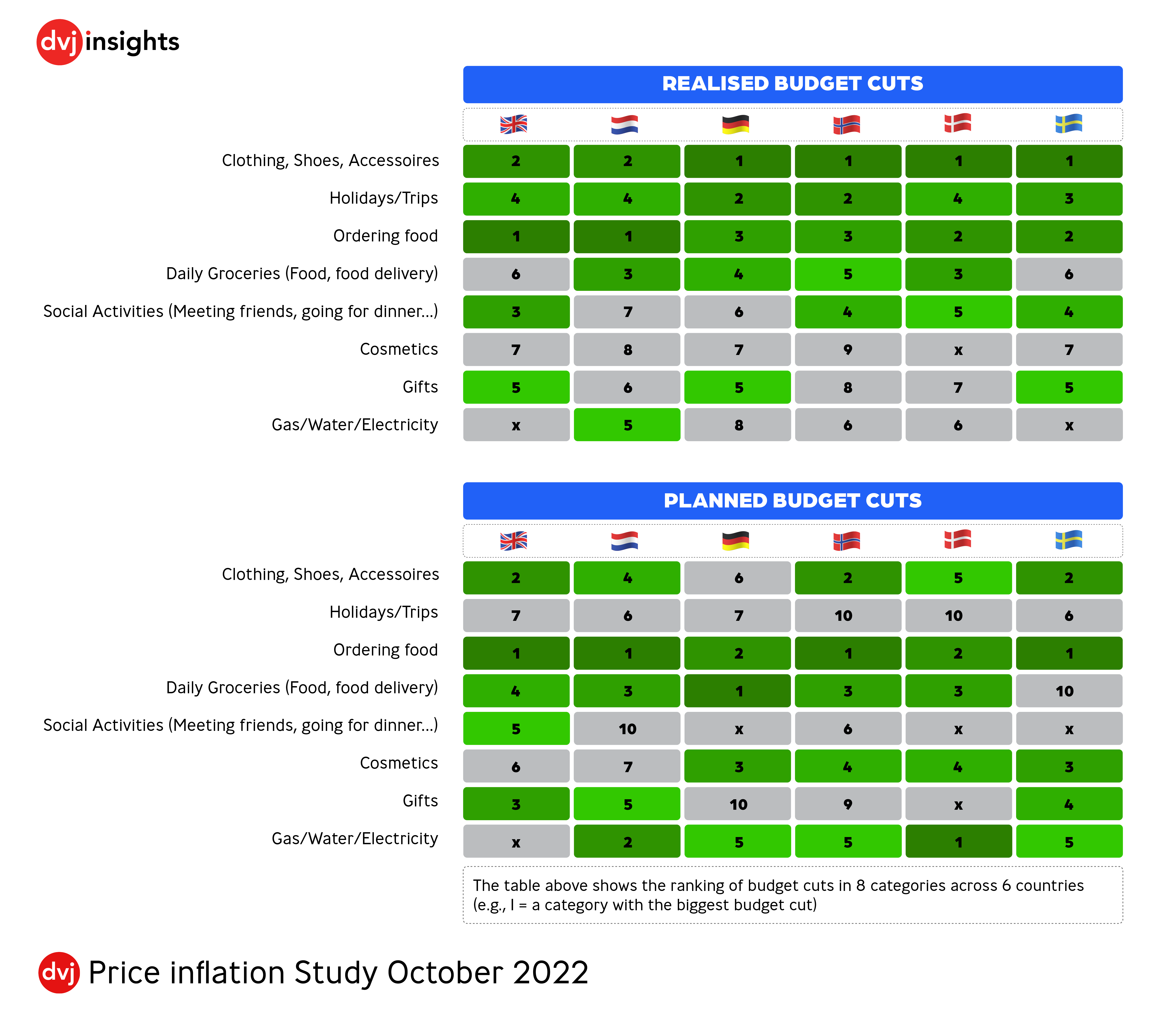

Only a few UK consumers have been able to reduce their spending on transportation and commuting. The majority of the savings have come from budget cuts in ordering food and clothing purchases. The emphasis is now on areas where money can be saved easily. Consumers have already implemented significant savings, so overall shares of planned cuts are declining.

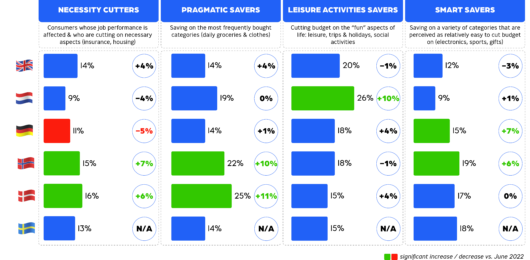

Saving strategies differ per country

Response strategies to price inflation differ across the countries studied. Norwegians and Danes are more “pragmatic savers”, whereas the Dutch are more “leisure activities savers” cutting budgets for fun aspects such as leisure, trips and holidays, and social activities. In Germany, more consumers are reducing their spending on categories where it’s easy to cut like leisure activities, electronics, sports, and gifts. In general, the Nordic countries are more “smart savers”, cutting back on electronics, sports, and gifts.

Changes in the way we eat

In the past four months, 48% of the British have cut back expenses on ordering food, and 31% plan to decrease their spending even more on this category. In terms of groceries, more than half (57%) are using savings programs. Alternatively, they purchase cheaper options (52%) and switch to retailer brands (56%).

Another trending phenomenon is delaying unnecessary purchases, especially in the category of house appliances, home improvements, holiday trips, and clothing category, In the upcoming months, Brits are also planning to spend less on gifts and sports (22%) which might even further affect their mental health.

Research Method

The study is conducted among 1,250 people 18+ years old in Germany, the Netherlands, the United Kingdom, Denmark, Norway, and Sweden. This number is the national representative. In addition, a representative sample by gender and age was used. Based on this sampling method, we can state that the results represent the opinion of these five countries as it was at the time of measurement.Research method DVJ Insights

MORE INSIGHTS?

The report with more results from the study in terms of emotion, finance, and how people cope with the current inflation can be downloaded here.