The power of the right insight

Gepubliceerd op 18 10 2023A STUDY ON THE ROLE OF THE INSIGHT IN DRIVING INNOVATION ACCEPTANCE

Mark Vroegrijk

Senior Specialist Data, Science & Analytics

Buying a newly introduced product always comes with a certain degree of risk. After all, uncertainty exists concerning which benefits the product can potentially offer and/or to what degree it actually succeeds in doing so. Therefore, in order for a new product to be successful, it is important that consumers are already fully “on board” with the “big idea” that underlies the innovation – and recognise and appreciate the value it will add to their lives.

This big idea, also known by marketers as the “insight”, can be seen as the driving force behind innovation and consists of:

- A universal truth: a desire or need that the vast majority of consumers can identify with

- A friction: the barriers and challenges that (currently) make it difficult or even impossible to satisfy this desire or need

- A perfect situation: a description of what the consumer’s “new reality” would look like in case these barriers and challenges would be resolved

At DVJ Insights, we gauge the degree to which an insight resonates with consumers by first asking them to write a story in response to the insight. If consumers truly feel understood, we expect them to tell elaborate and rich stories – which is why we also ask consumers to rate their stories on several “story markers” (aspects such as credibility, relevance and uniqueness). The higher the scores on these story markers, the better the quality of the insight is.

Introduction

Through a meta-analysis across 70+ product innovations, we demonstrate that this quality of the insight by itself already plays a big part (±40%) in determining the acceptance of an innovation. This is mainly because consumers’ evaluation of the full product (e.g., in terms of perceived added value, distinctiveness and relevance) strongly depends on how much they find the underlying insight appealing. The especially important qualities of the insight are credibility, easiness of understanding and shareability (consumers want to talk about the insight with their peers). Figure 1 below provides a visual summary of our findings.

Figure 1: Visual summary of main findings from meta-analysis

+ Total explanatory power (R2): ±50%

++ Total explanatory power (R2): ±80%

Our findings on the role of insight imply that, when brands develop new products, it is just as important to test the insight as it is to test the fully realised product concept. Only once the barriers that play a role in large-scale innovation acceptance are properly identified, they can be acted upon. Is it the original insight itself that consumers are unable to identify with? Or is it the execution of the concept that is lacking instead?

GOOD INSIGHTS FOSTER ACCEPTANCE

To determine how big of a role the quality of the insight plays in consumer acceptance of new products, we will analyse a subset of 72 innovations from our concept testing database. For all of these cases, we have data on:

1) the quality of the insight (through scores on six story-markers as described above)

2) the evaluation of the full product concept (through scores on eight aspects)

3) the acceptance rate of the full product concept (obtained from our Accepter-Rejecter model)

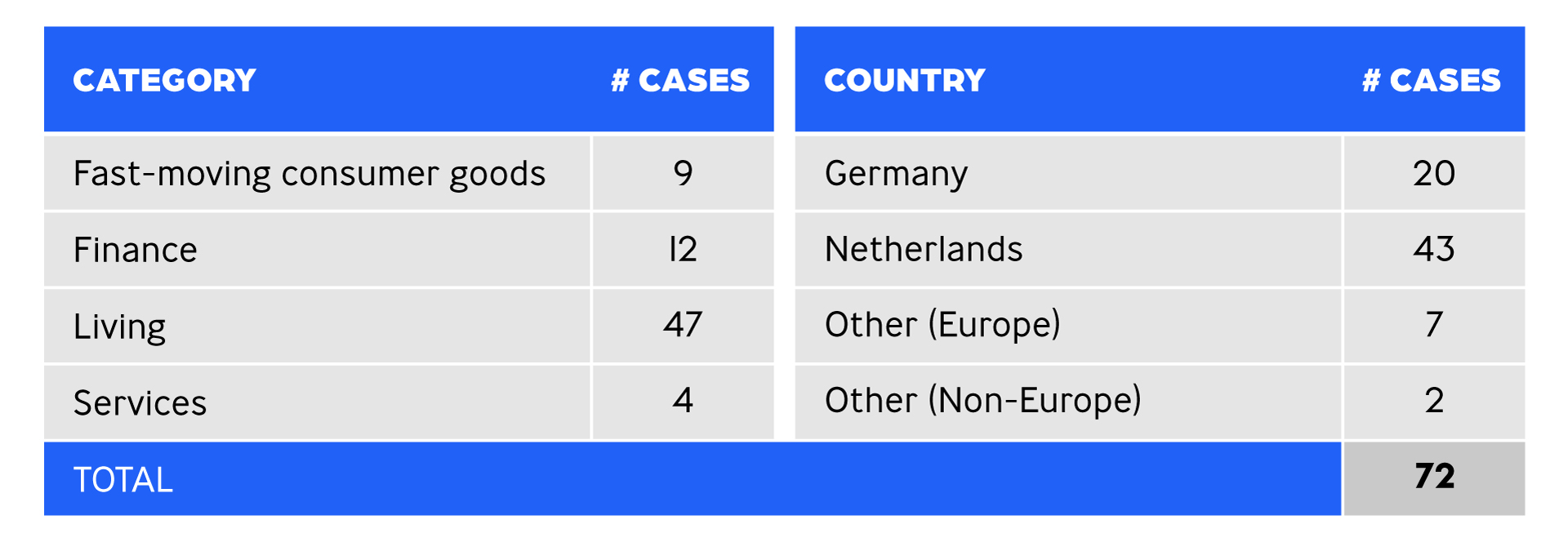

Table 1 below summarises the different categories and countries that are covered by this data set.

Table 1: Number of product innovation cases covered by each category and country

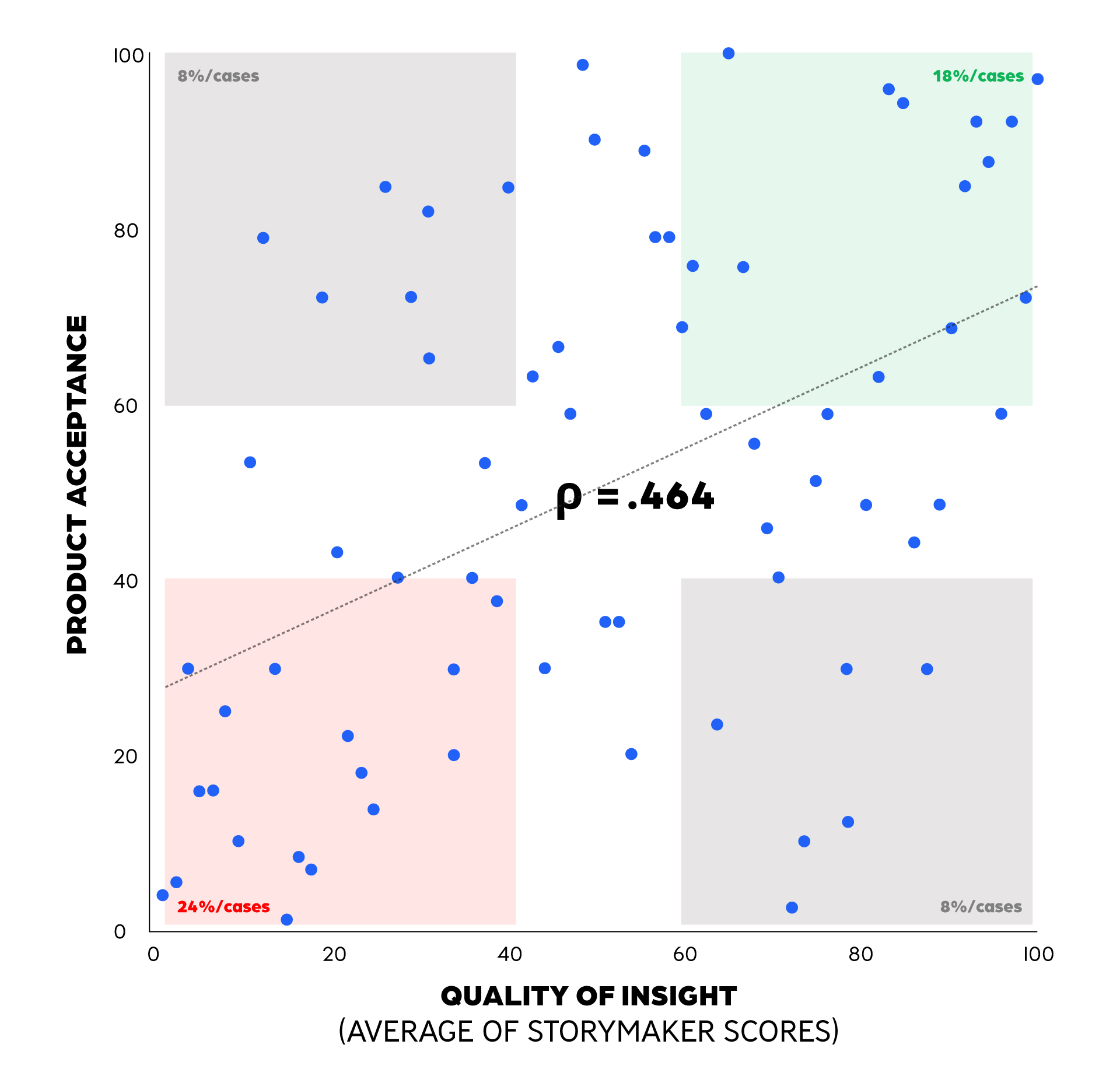

First, we answer the question: Is the openness of consumers to a product innovation influenced by the quality of the insight behind it? Figure 2 below plots the acceptance scores for the 72 concepts against their average scores across the six story markers (which proxy for how well the insights resonated).

Figure 2: Scatterplot of (percentile) scores on insight quality versus innovation acceptance

Thus, “Yes” is our answer to the question above – with the plot showing that there is indeed a fairly strong relationship between the quality of an innovation’s insight and its eventual acceptance by consumers (with a correlation of ±.50). When innovation is built on an insight consumers cannot properly connect with, it is relatively rare to turn this around and still do well in terms of overall acceptance (8% of cases in the top-left corner, versus 24% in the bottom-left). At the same time, innovations with well-received underlying insight are majorly being well-accepted (18% of cases in the top-right corner, versus 8% in the bottom-right).

Creating an appealing insight thus helps in influencing consumers to accept an innovation. However, there’s absolutely no guarantee, given that we still observe cases in the bottom-right corner of the plot.

“While an attractive idea is certainly important for an innovation to be well-received, its future success also depends on how well this idea is executed.”

A MODEL OF INSIGHT QUALITY, PRODUCT APPEAL & ACCEPTANCE RATES

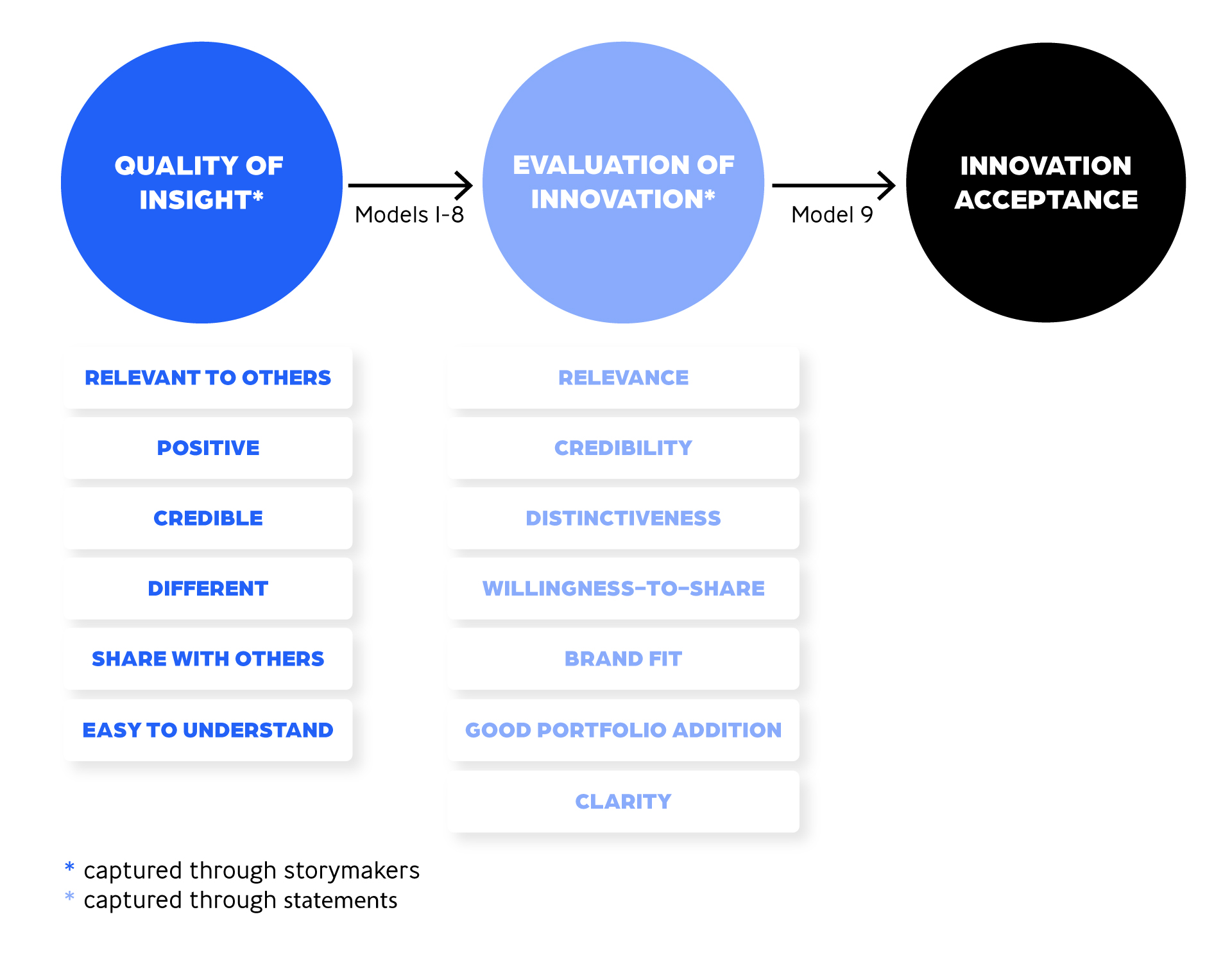

Further, we want to assess how acceptance of an innovation is driven by its underlying insight versus how that insight is turned into an actual product. Hence, we conduct a series of regression analyses that link (as is graphically displayed in Figure 3 below):

1) the quality of the insight (as captured by the six story markers),

2) the evaluation of the innovation that builds upon this insight (across eight aspects),

3) the eventual acceptance of the product.

Figure 3: Schematic representation of estimated regression models

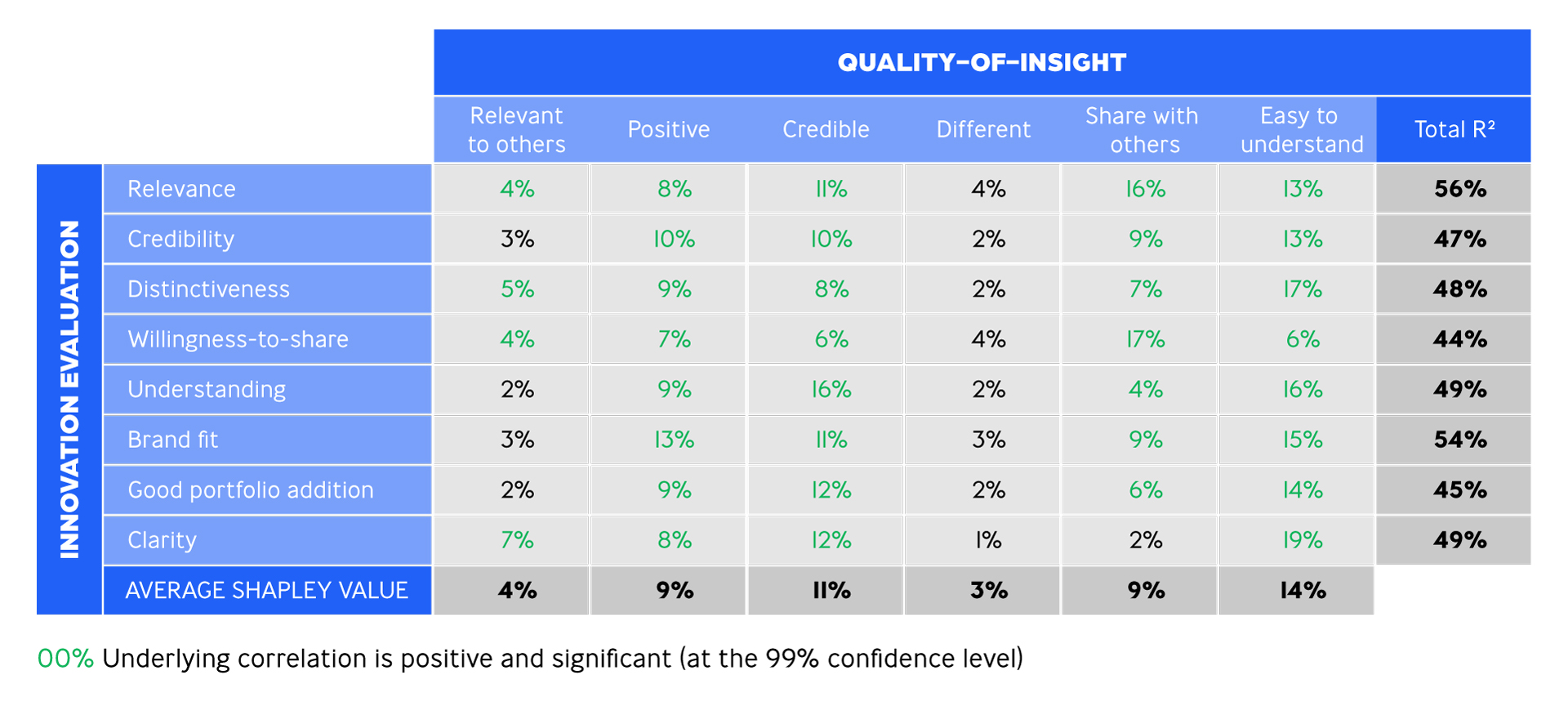

As a first step, we want to assess to what extent the quality of an insight determines how consumers eventually evaluate the full innovation that builds on this insight. Table 2 shows that the reception of the “big idea” already explains about half of the response to the innovation itself (with the story markers reaching R2 values of 40%-60% on each evaluation dimension). This presumably leaves the other half for how well the translation from insight to actual product (benefits) was executed.

Table 2: Shapley values for insight story markers linked to innovation evaluation (models 1-8)

The average Shapley values for each story marker (displayed in Table 2) then show that especially the credibility (11%) and understandability (14%) of an insight are important drivers of a favourable response to an innovation. A valuable insight thus builds on a problem that consumers can easily recognise and relate to. It should also be a problem that they believe is open to a feasible solution.

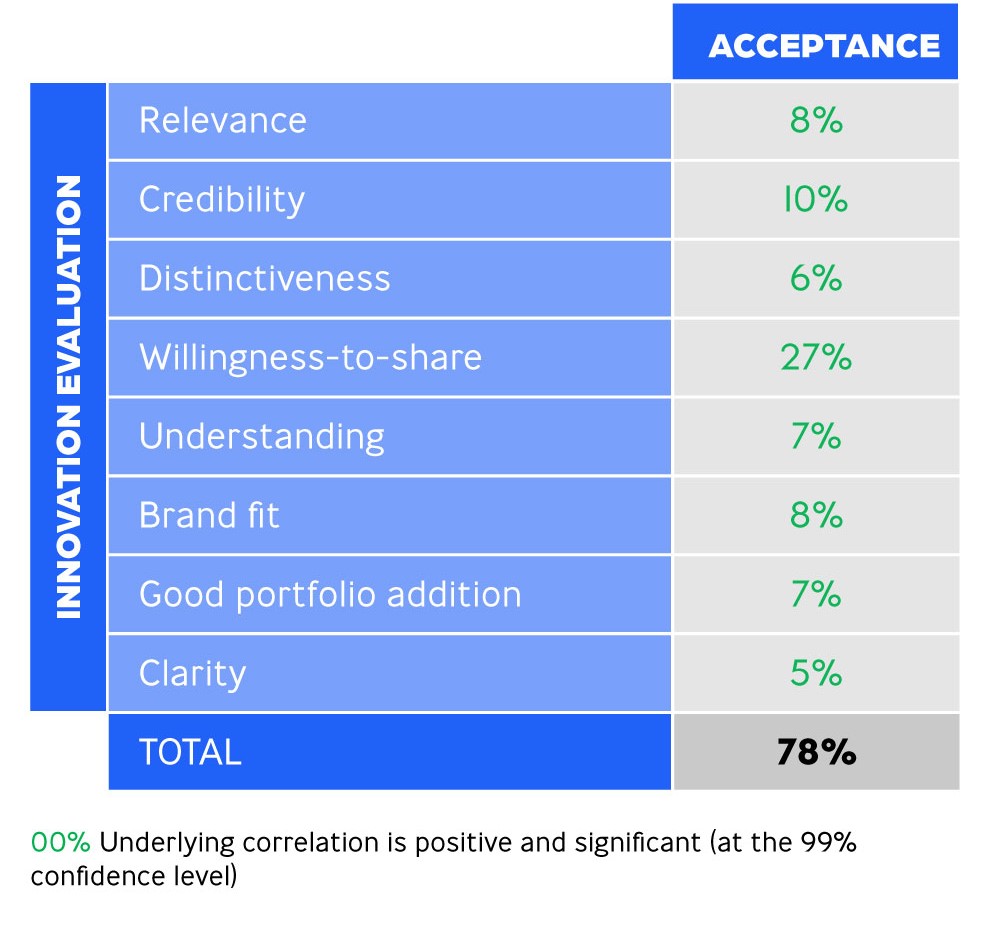

Now that we’ve established that consumers’ attitudes towards a product innovation tend to improve as its underlying insight becomes more resonating, we’d like to see if this improved evaluation leads to more consumers accepting the innovation. As Table 3 below shows, this relationship is very strong, with differences in evaluation between products accounting for almost 80% (R2: 78%) of the variance in their eventual acceptance. We can also see that, out of the eight evaluation dimensions, consumers’ willingness to share the product concept plays a particularly important role in driving acceptance (with a Shapley value of 27%). Referring to the table above, this characteristic is largely shaped by how eager consumers are to share their initial insight with others. This highlights its significance as a vital factor for success. It underscores the importance of creating an engaging insight based on a “universal truth.” Such insights connect with common needs and aspirations that people believe others will also relate to and find recognizable.

Table 3: Shapley values for insight story markers and innovation evaluation linked to acceptance (model 9)

All in all, and not too surprising, consumers mostly decide whether to accept a new product based on their attitudes towards the product itself. However, we also found that these attitudes by themselves are driven considerably by how well the initial “big idea” connects with people.

“This means that a big part of whether an innovation will be accepted depends on how good the original insight is.”

Looking at the combined explanatory power of our regression analyses, our research suggests that around 40% of the differences in acceptance between different product ideas can be explained by the quality of the initial insight alone.

SHEDDING LIGHT ON AN INNOVATION’S TRUE POTENTIAL

The results of our meta-analysis show the fundamental role played by the insight (or “big idea”) itself in getting a new product, that is based on this insight, widely accepted by consumers. About 40% of the variation in acceptance across different innovations can already be traced back to differences in the quality of the original insight. In the initial phases of new product development, it is therefore vital to spend sufficient care and effort in “getting the insight right”. Our analysis revealed three properties of the insight that are especially impactful:

- The insight’s “universal truth” should tap into desires or needs that many consumers 1) can easily understand (i.e. recognise and identify with) and 2) actively talk about with one another (and are thus at the forefront of their minds)

- The proposed “perfect situation” in which these desires or needs are actually realised should be a credible scenario – with consumers truly believing that any barriers and challenges between them and their desires or needs can be overcome

One insight from our database that scored especially well on these three aspects, for example, was one that revolved around the desire to serve highly nutritious but also good-tasting food to the entire family, ensuring that everyone at the table is eating healthy while remaining “in good spirits”.

Our findings also emphasize the importance of early testing of an insight among the intended audience. If the insight doesn’t resonate well, it’s a clear sign that the full innovation might also struggle to gain acceptance. This early feedback offers the opportunity to make necessary adjustments before significant costs are invested in design and development.

Alternatively, even if practical reasons prevent an insight from being tested early on, separate testing of an insight from the fully realised concept is still valuable. After all, it helps identify areas that require improvement for a successful innovation launch—is it the initial idea itself or its execution that needs refinement?