EMOTIONAL DESPAIR AND FURY

Consumers are much more emotionally overwhelmed by the current price inflation compared to their state four months ago. The English, Dutch, and German consumers are now not only worried, but also getting anxious, angry, and frustrated. This is in line with the inflation figures: Price inflation is the highest in the Netherlands at 14.3%, followed by Sweden (10.8%), Germany (10.4%), the UK (10.1%), and Denmark (10%). Norway shows the lowest actual price inflation (6.9%) (Trading Economics, 09.11.2022).

When Dutch consumers encountered price inflation four months ago, they had a much more laid-back approach compared to now, when they indicate that price inflation is causing them serious financial problems. Although in June, the Nordics seemed to cope quite well with the price inflation, they now notice the high prices and share their feelings of concern.

Compared to the first wave, more Dutch, German, and Danish consumers feel that the global economic and financial situation is getting slightly worse. Norwegians are more optimistic regarding global economic expectations.

MAJOR IMPACT ON DAILY LIVES

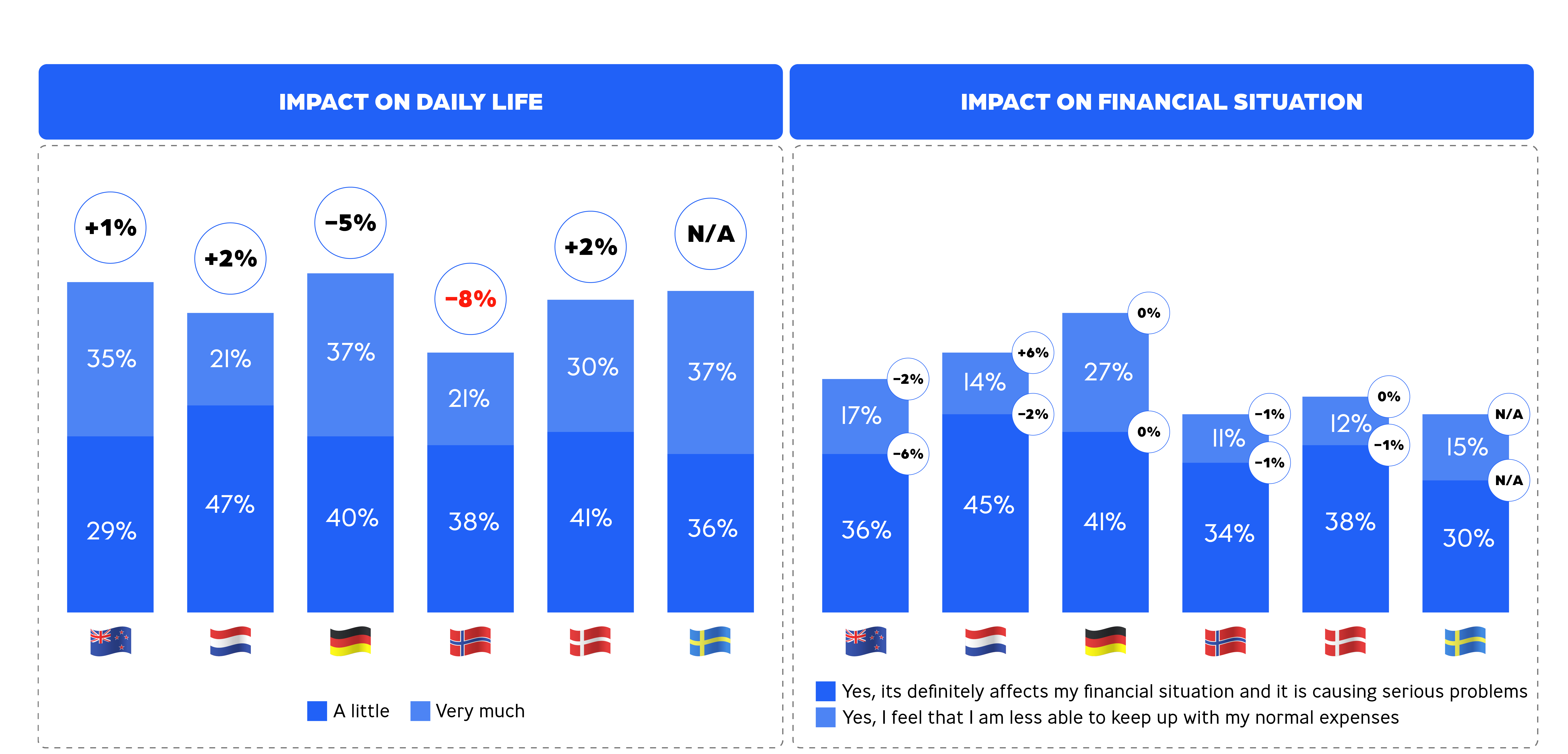

We asked respondents how much current price inflation affects their daily lives. In comparison to the previous study conducted in June this year, the perceived impact on consumers’ daily lives and financial situations remains very high.

Germans, Swedes, and Britons are the most concerned. On average, one-third of them have experienced or expect to experience a significant impact of inflation on their daily lives. The impact on the Dutch and Norwegians is less significant, with 41% of the Danes feeling only a minor impact on their lives and only 21% feeling very impacted.

Around 50% of the respondents currently experience struggles with their finances as they feel less able to keep up with their normal expenses, In Germany, 27% of respondents believe that current price inflation is causing serious problems. The Dutch have now realized that inflation has a significant impact on their actual personal financial situation. Only Dutch consumers believe that current price inflation is having a significant impact on their financial situation, compared to four months ago.

COPING WITH PRICE INFLATION

In the UK and the Netherlands, more consumers confirmed a significant impact on their daily lives than four months ago. We even see a serious “socially strained effect,” with people in the UK, Germany, the Netherlands, and Sweden reporting a significant impact on close relationships with their partners, family, and friends. Both the Germans and the Swedes feel the most like “crisis victims,” with significant effects on their daily lives, financial situations, and even mental health.

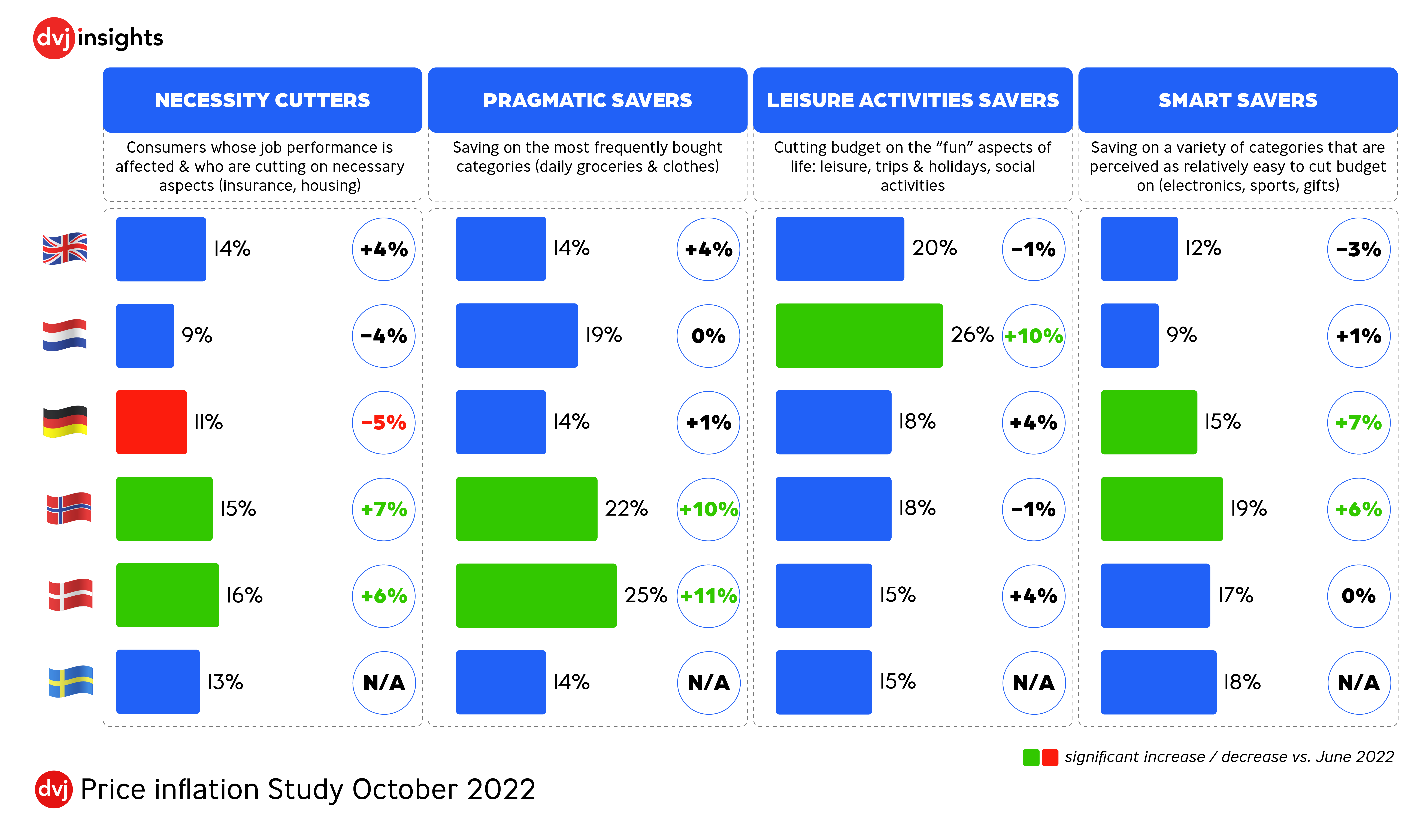

Response strategies to price inflation differ across the countries studied. Norwegians and Danes are more “pragmatic savers”, whereas the Dutch are more “leisure activities savers” cutting budgets for fun aspects such as leisure, trips and holidays, and social activities. In general, the Nordic countries are more “smart savers”, cutting back on electronics, sports, and gifts.

Inflation affects all income groups equally, though the lower income groups may suffer more. The majority of smart, pragmatic, and leisure activity savers are over the age of 55 whereas the younger generation is affected in their social lives and forced to cut back on necessities.

TOP 5 BUDGET CUTS REALIZED

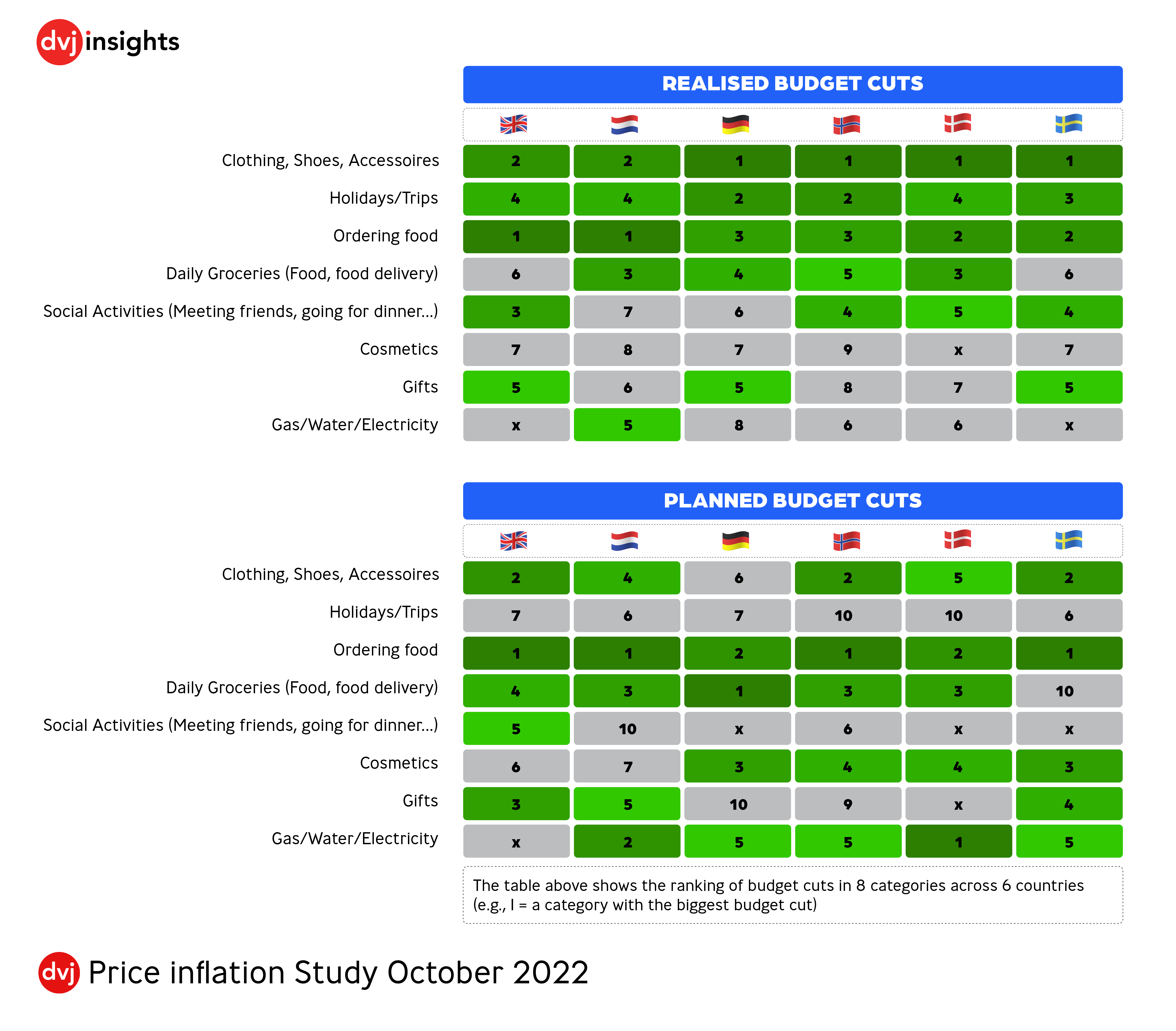

Consumers have a clearer view of which categories they want (and can) cut expenses compared to summer. Categories that fall within the basics and essentials of daily life, where making the right choices is critical, are also the most difficult to cut costs. In the last six months, the top 3 categories on the chopping block have been clothing, shoes, and accessories, ordering food, and holidays. In the past months, 45% of consumers have cut back on ordering food.

As of June 2022, Dutch and Danish consumers have reduced their spending on daily groceries, clothing, shoes, and accessories, and ordering food. These categories are is in the top 3 of the British, whereas they feel that choices in holidays and investments are important. Both German, Swedish, and Norwegian consumers have been cutting expenses the most on clothing/shoes/accessories, holidays/trips, and ordering food.

Across all countries studied, ordering food (33%) is by far the easiest and most likely in which consumers plan to save the most money in the upcoming six months, followed by attempts to save on gas, water and (29%), clothing, shoes, accessories (28%) and cosmetics (27%). Consumers don’t plan on making stronger cuts to their social activities. Cutting back on sports is now within the top 10.

LET´S BUY THIS LATER

One of the most popular saving strategies among our respondents is delaying the purchase, which is applied in the majority of spending categories. This tactic dominates mainly in the categories of: home improvements and household appliances, electronic devices for personal use, pharmaceuticals, diet supplements, and travelling. In addition, consumers tend to go on fewer trips and prefer using alternative ways of transport apart from flying. Regarding daily groceries, consumers reduce purchase volumes or go for cheaper alternatives.

LOOKING FOR DEEPER INSIGHTS INTO YOUR CATEGORY AND BRAND?

Interested in more specific insights into planned cuts per country (e.g., daily groceries, personal electronic devices, household appliances and improvements, cosmetics, or insurance), or saving tactics by category per country? Feel free to download the full report.

Do you want us to support you in dealing with price inflation, for example, by testing and improving advertising, increasing product innovation, conducting price research, increasing mental availability, conducting claim testing, package testing, or brand tracking?

Send us an e-mail to stephan.knaeble@dvj-insights.com (Germany), roderik.sorbi@dvj-insights.com (The Netherlands) or jemma.toynebee@dvj-insights.com (The UK).

DOWNLOAD THE REPORT

Get ready for more insights into the emotional impact per country, budget cuts, and how people cope with inflation regarding (cheaper) alternatives, promotions, and attention towards advertising.

Fill in your details below to download the report.

Required field*

RESEARCH METHOD DVJ

The study is conducted among 1,250 people 18+ years old in Germany, the Netherlands, the United Kingdom, Denmark, and Norway. This number is the national representative. In addition, a representative sample by gender and age was used. Based on this sampling method, we can state that the results represent the opinion of these five countries as it was at the time of measurement.